Want to go solar but can’t afford them? Don’t worry! These top solar financing companies listed in this blog will assist you in financing your solar project with their unmatched solar loan plans. So keep reading to find out who they are.

While it is true that solar panel technology costs have declined over the past decade and that the federal and state governments are encouraging people with their robust solar incentive and rebate programs, it is still expensive for homeowners to install PV panels on their rooftops and can cost them somewhere around $10,000 to $30,000 or even beyond (based on the project).

The national average cost of installing solar panels is around $23,879 before the 30% federal solar ITC, and after applying for it, the price cuts down to $16,715, which is still even more than two times the average salary of an American.

In light of these facts, it is evident that taking assistance from solar financing companies can help residents afford solar panel installation with their reasonable monthly installment solar loan plans. And there should not be a second thought about doing this.

A report on energy efficiency and renewable energy states that 85% of residential photovoltaic panels are financed. If seen from a broader perspective, it is a wise decision both financially and environmentally.

However, with the plethora of options available on the market, finding the right one is challenging.

This is why we have come up with this comprehensive guide to solar financing companies, in which, after a solemn conversation with countless solar installers, we have pinned down the best ones for you.

So, without further ado, let’s dive into them.

The Best Solar Financing Companies

To make your solar experience smoother and better, below we have narrowed down and compared the 6 best solar financing companies for you:

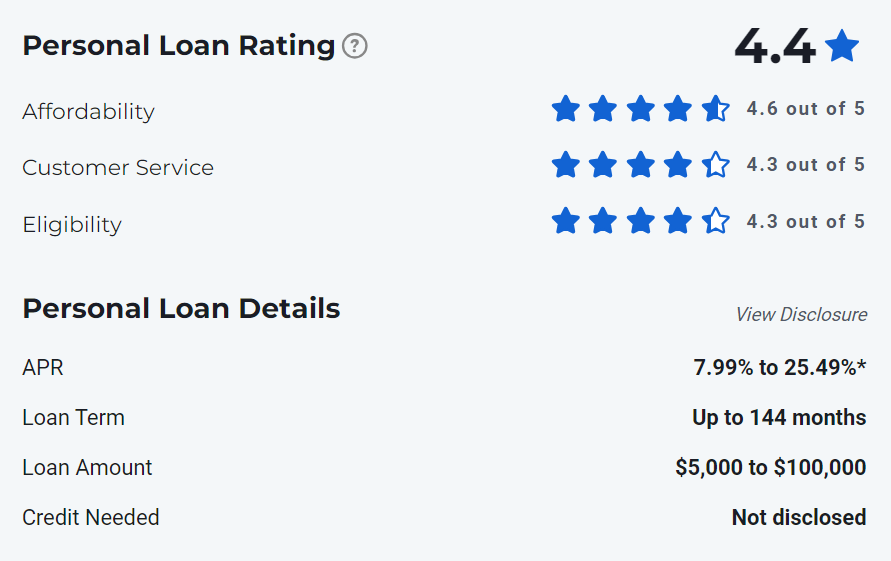

LightStream – Best for Low-Interest Rates

| Offers | Solar loans |

| Available in | All 50 states and Washington D.C. |

| BBB score | A+ |

| Rating | 4.4 |

| Minimum credit score | 660 |

| Loan Amount | $5,000 – $100,000 |

| APR | 7.99% – 25.49% with autopay |

LightStream is an online premier consumer lending division of Truist, a financial bank holding company in North Carolina that was formed after the merger of SunTrust Bank and BB&T. From solar panels to automobiles to home refurbishing services, it offers low-interest and fixed-rate loans for any project.

The platform believes in providing the best and easiest loan financing experience to its customers and offers loans ranging from as little as $5,000 to a maximum of $100,000 based on their project purpose.

Also, it doesn’t impose any origination, late payment, or prepayment penalties in addition to providing enticing and adaptable terms. The lender provides a 0.50% rate savings for customers who sign up for autopay, a bigger benefit than most lenders offer.

How to qualify?

You must have a credit score of 660 or higher to be eligible for a residential solar panel loan from LightStream. Concerning the financing amount and your needs, loan terms can range from 2 to 12 years. The range of interest rates is 7.99% to 21.24%. There aren’t any costs, fines, or conditions for home equity loans. Therefore, if the rate of interest looks expensive, just remember that there aren’t any other expenses associated with it.

How to apply?

Applying for a LightStream loan is easy, 100% environment-friendly, i.e., virtually paperless, and can be done in three simple steps:

- Apply directly via their website or mobile device. You will get a response within business hours.

- Once the loan is approved, e-sign the loan agreement.

- That’s it. Your work here is done.

Pros

- Fast loan approval and funding.

- No additional fee is levied; there are no home equity requirements.

- Low and competitive interest rates.

- Offer excellent rewards in exchange for a good credit history.

- Make unlimited transactions.

- Provides a robust customer support system.

Cons

- There is no pre-qualification process for loan approval.

- Fixed turnaround time for applying and signing loan agreements before 2:30 p.m. No flexibility.

Customer Reviews: According to U.S. News Ratings,

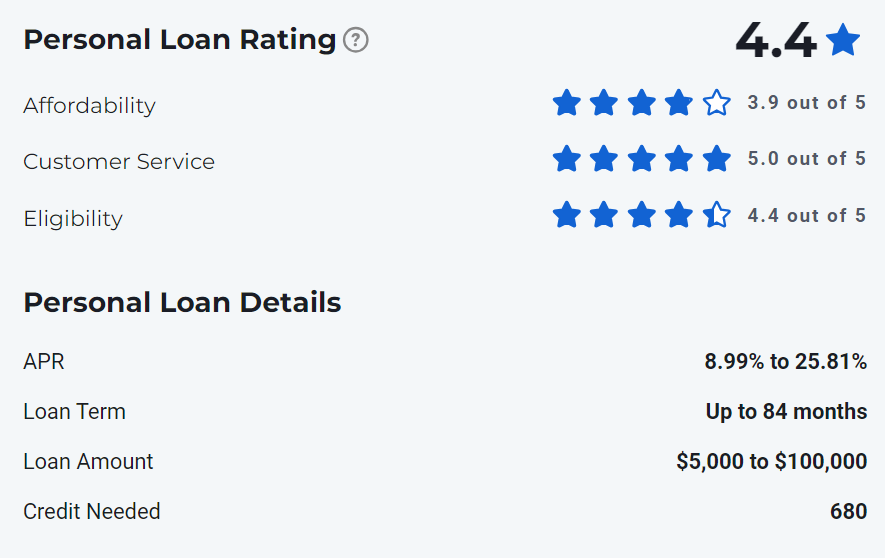

SoFi – Best for Same-Day Funding

| Offers | Home Equity Loans, and Solar Loans |

| Available in | All 50 states plus the District of Columbia |

| BBB score | A+ |

| Rating | 4.4 |

| Minimum credit score | 680 |

| Loan Amount | $5,000 – $100,000 |

| APR | 8.99% – 25.81% with autopay |

SoFi is an internet lending marketplace that provides unsecured locked-in individual loans in all states of America. Since its founding in 2011, SoFi has made more than fifty billion dollars in loans, and it distinguishes out by enabling large loan sums and making long loan durations available.

With loans ranging from $5,000 to $100,000, SoFi is a fantastic solar financing company for anyone with outstanding credit who is looking for a sizable solar loan. The allowable loan amounts depend on the state in which you reside.

For instance, due to regulatory regulations, minimum loan requirements in some states may be higher than $5,000. For the same reason, fixed/variable rates may be less in some areas, which may affect your ability to obtain a SoFi loan.

How to qualify?

You must have a credit score of 650 or higher to be eligible for a personal loan from SoFi. Additionally, you must have an annual income of over $45,000; however, the average annual income of a SoFi borrower is over $100,000, according to the company. Next, based on your financing amount and needs, you can select a loan period ranging from 2 to 7 years at a fixed APR range of 8.99% to 25.81%. There are not any other additional charges, plus the rates are fixed, so consider it a good deal in the long run.

Know more about their loan eligibility criteria.

How to apply?

Applying for a SoFi loan is easy, and can be done in three simple steps:

- In 60 seconds, see the rate you are eligible for without committing.

- Select a loan period between 2 and 7 years, then complete your online application.

- As soon as you sign your paperwork, money will be transferred to your bank account on the same day. That’s it. Your work here is done.

Pros

- Low fixed rates will save you from potentially rising interest rates in the future.

- No additional fee is required, including the origination fee, prepayment penalty fee, or late fee.

- Get your funds as soon as possible, on the same day as your approved loan.

- Flexible terms range from 2 to 7 years.

- There is a pre-qualification process with a soft credit check.

Cons

- No co-signers are allowed.

- Some applicants have found the pre-qualification process a bit complicated.

- The loan amount goes directly into the borrower’s account and not to any third-party creditors.

Customer Reviews: According to U.S. News Ratings,

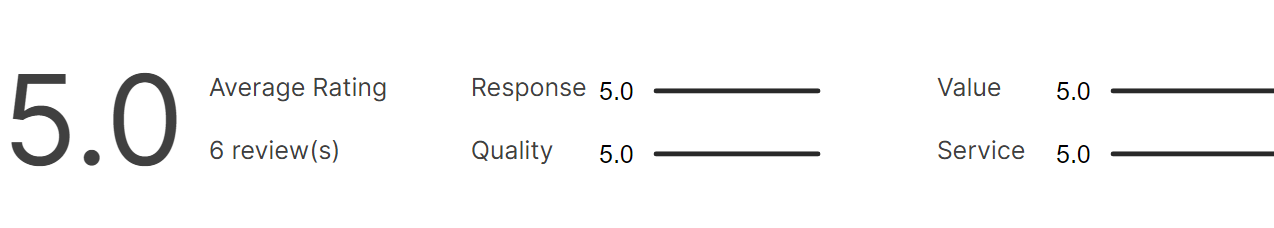

Energy Loan Network (ELN) – Best for Low-Interest Rates

| Offers | Home Improvement Loans, and Solar Loans |

| Available in | All 50 states and Washington D.C. |

| BBB score | A+ |

| Rating | 5 |

| Minimum credit score | No minimum credit score required |

| Loan Amount | Not Available |

| APR | 2.49% – 7.99% |

Energy Loan Network is an online network that aids in establishing relationships between consumers, contractors, and lenders that are members. It is a specialized finance firm that mostly collaborates with financial institutions to offer clients funding for their residential solar installation. ELN is not a broker, direct lender, or provider of financial services.

The business runs a network that links lenders with solar installers that sell and set up home solar systems. Lenders frequently provide discounted prices to customers who use ELN to obtain loans. The company also provides loans for home improvements, including energy-saving initiatives like insulation and HVAC repair.

Because of their affordable products and outstanding service, ELN’s network of lenders is utilized by many solar contractors and householders. Furthermore, the industry’s lowest monthly payments are provided by lenders in their network, allowing borrowers to save more cash each month and significantly raising closing rates. It also provides the most customer-friendly payback terms, free of homeowner fees and pre-payment penalties.

How to qualify?

ELN financing solutions typically offer fixed interest rates averaging 5.24%; however, this percentage can vary based on the borrower (contractor or homeowner), its credit score history, and the lender itself. As of now, there is no minimum credit score required to qualify for the loan, but the higher it is, the better it will be for you. Next, based on your financing amount and needs, you can select a loan period ranging from 8 to 20 years at a fixed APR range of 2.49% to 7.99% with no prepayment penalty fees. There are not any other additional charges.

How to apply?

Applying for an ELN financing solution is easy, and simple. A solar contractor or homeowner can submit their application via their website. Next, either the applicant can complete their form with the ELN team or a link can be sent to them so that they can fill it out at their convenience. And their work here is done.

Pros

- A distinct and simple financing application process makes it easy for contractors and homeowners to submit their applications.

- Easy and transparent communication. The applicants are given daily updates on their process, and in case of any doubt, they can reach ELN’s friendly team 24/7.

- You will get the lowest interest rates in the industry. Get your payable checks handy as soon as each stage of your project is completed.

- Provide fixed interest rates for the entire tenure of your loan.

- Offers flexibility with its affordable period and payment terms.

Cons

- There are no cons, as such.

Customer Reviews: According to the EnergySage Ratings,

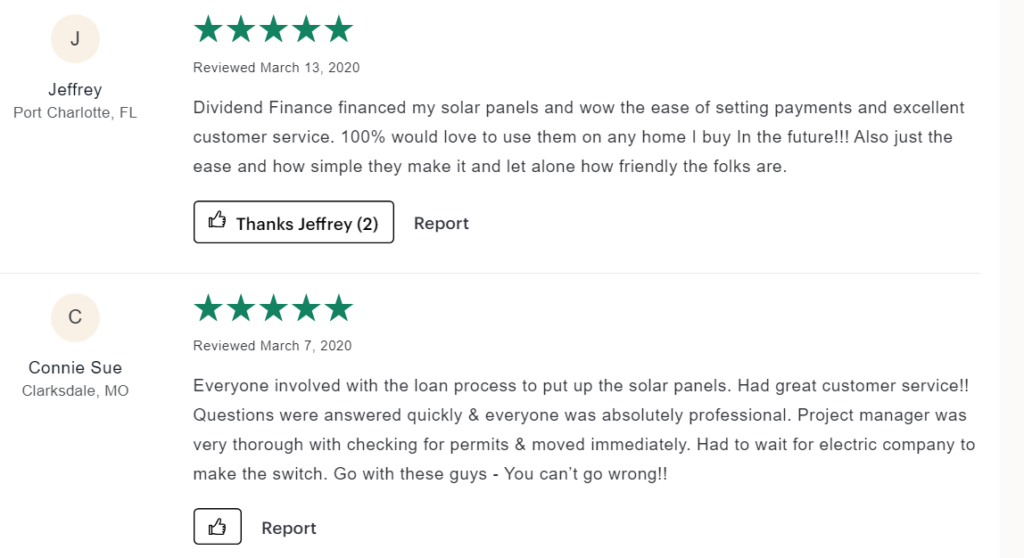

Dividend – Another Good Option for Solar Financing

| Offers | Home Improvement and Solar Loans |

| Available in | All states except Montana, North Dakota, South Dakota |

| BBB score | A+ |

| Rating | 4 |

| Minimum credit score | No minimum credit score required |

| Loan Amount | $20,000 to $50,000 |

| APR | as low as 3.99% |

Dividend is a solar energy lending company and is a registered trademark of Fifth Third Bank that provides a range of credit choices for those looking to invest in solar power and renewable energy. Most borrowers receive loans for their solar project finance in the range of $20,000 and $50,000.

To minimize tension, the company has created a stress-free loan application process. They can now apply for loans via their website, have the option to make payments automatically, and receive rapid credit decisions. Also, the loans for the Dividend have fixed rates, are tax deductible, and have no prepayment fees.

To aid customers in getting top-notch solar power systems, the organization collaborates with over 700 solar installation companies. However, Dividend Solar doesn’t handle the installation; instead, a different firm conducts it, and you’ll need to get in touch with them to finish the job.

How to qualify?

For consumers who are unable to obtain loans through conventional banks or other online lenders, applying for a solar loan from Dividend may be more convenient. This is because they focus on providing loans made for customers with light credit checks that don’t damage credit ratings.

They use the full of the applicant’s credit history in addition to the applicant’s credit score when determining whether or not to approve a loan application. Next, you can choose a loan term between 10 and 25 years with a fixed APR as low as 3.99% based on the amount of finance you need.

How to apply?

Applying for a Dividend loan is easy, and can be done in four simple steps:

- Single-page applications that may be launched with a single click and don’t require logging in.

- Under two minutes from application to signed documents.

- It is possible to transmit directly to customers for self-application.

- Tools for simple project tracking and business expansion.

Pros

- There are no prepayment or repayment penalty charges.

- Offers multiple solar options, including EmpowerLoan and PACE Loan.

- A fast and single-page application process is required for loan applications.

- Provides real-time sales support.

- Goes through a soft credit check that does not affect credit scores.

Cons

- You need the help of solar installers for solar financing. You can’t apply directly to it.

- The company does not provide solar loan services in Montana, North Dakota, or South Dakota.

- Can make payments only with Autopay.

- No solar lease or PPA options

Customer Reviews: According to consumeraffairs.com Ratings,

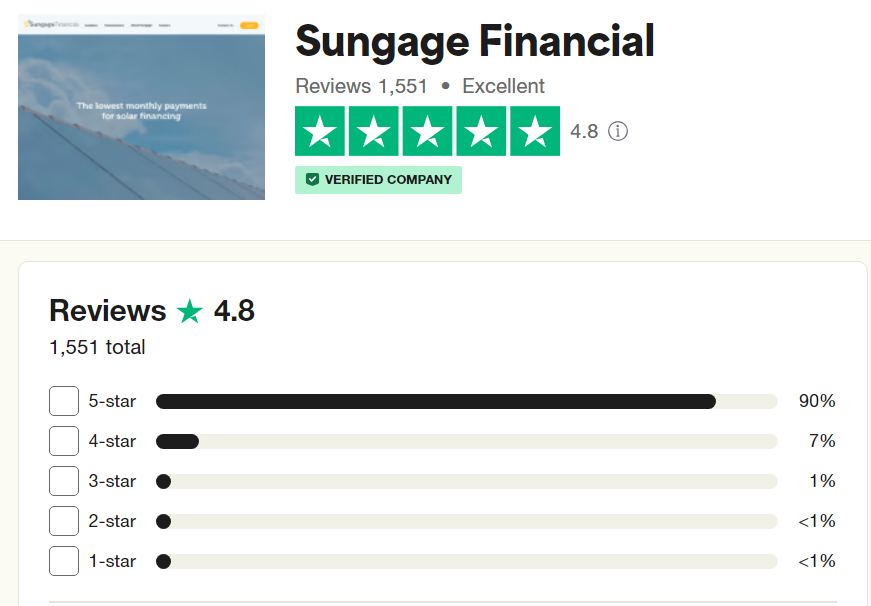

Sungage Financial – Best for Same-Day Funding

| Offers | Solar Loans |

| Available in | All 50 states |

| BBB score | A+ |

| Rating | 4.8 |

| Minimum credit score | No minimum credit score required |

| Loan Amount | up to $150,000 |

| APR | Not Available |

Sungage is well-liked by homeowners because of its reputation for being simple to work with and its mandate to provide financing, particularly for residential solar installation. The firm provides mortgages up to $150,000, which is the most amount that has been offered for a solar energy system loan (and significantly more than most households require).

Through Sungage, you can obtain funds for a maximum of twenty-five years with complete project finance available. This applies to roof work, battery storage, and solar. Fees, appraisals, and home equity requirements are all nonexistent. Many customers receive immediate clearance for their PV loan thanks to the simple online application and attentive customer support staff.

Sungage keeps a list of knowledgeable, professional solar contractors and will put you in touch with one to create an installation for your house. The technician will then give you an access code to a safe, electronic credit request that should only take five minutes to complete after you’ve read the proposal, which includes information on the energy bill savings you can anticipate. The contractor can begin right away after receiving a prompt choice.

How to qualify?

For consumers who do not have a robust credit history, applying for solar financing from Sungage may be more convenient. This is because they focus on providing loans to customers with light credit checks that don’t damage their credit ratings.

How to apply?

Applying for an Sungage financing solution is easy, and simple. Simply fill out an online application to receive an assessment of credit in a matter of seconds without affecting your credit score.

Pros

- Provides a loan to fund your entire solar project.

- No additional home equity requirements or hidden charges

- Goes through a soft credit check that does not affect your credit score history.

- No prepayment penalty charges

- Lets you connect with verified and approved solar contractors.

- Offers a solar tax credit that has not been provided by any other solar financing company.

Cons

- Provides loans only against the mentioned solar equipment and not against property.

Customer Reviews: According to Trustpilot Ratings,

LendingPoint – Best for Personal Load Funding

| Offers | Home Improvement Loans |

| Available in | 48 states plus the Washington, D.C. |

| BBB score | A+ |

| Rating | 4 |

| Minimum credit score | 600 |

| Loan Amount | $2,000 – $36,500 |

| APR | 7.99% – 35.99% |

LendingPoint, an internet lender with headquarters in Atlanta, provides personal loans to potential customers in the 48 states plus Washington, D.C., It does not provide loans in Nevada or West Virginia. Solar contractors or homeowners who live in these states are qualified and may submit applications online to get funding right away.

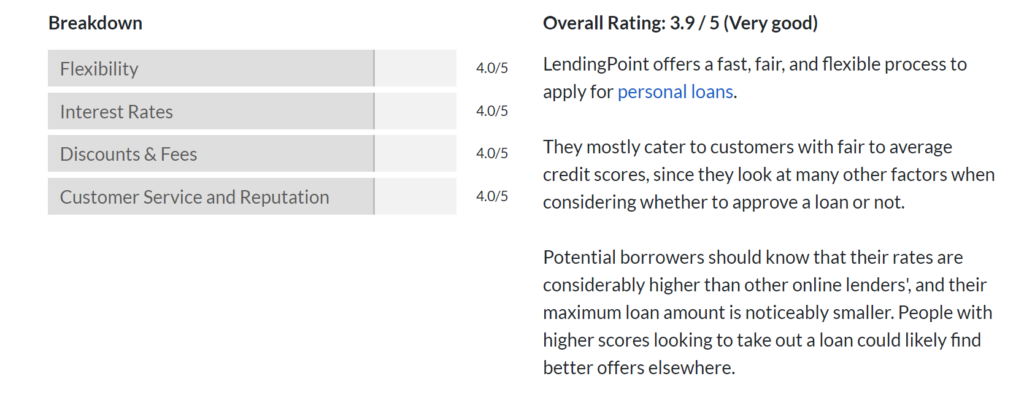

With customizable financing choices, APR varying from 7.99% to 35.99%, with repayment durations of 24 to 72 months, they provide personal loans between $2,000 to $36,500.

Additionally, applicants should be aware that their interest rates are significantly higher than those of other online financial institutions and that the size of their maximum loan is markedly less. Higher-scoring borrowers who are looking for loans may be able to discover better deals elsewhere.

How to qualify?

It might be simpler for borrowers who can’t get loans from traditional banks or other internet lenders to get a personal loan from LendingPoint. This is because they concentrate on offering loans designed for borrowers with FICO scores between 600 and 680. They also established a $35,000 low-income barrier.

When deciding if to grant a person’s loan or not, they don’t only look at the applicant’s credit score; instead, they analyze the entirety of the applicant’s credit history. Next, based on your financing amount and needs, you can select a loan period ranging from 2 to 6 years at a fixed APR range of 7.99% to 35.99%.

How to apply?

Applying for a LendingPoint loan is easy, and can be done in three simple steps:

- Start by completing a short application to check your available payment alternatives without affecting your credit score.

- After that, choose a loan’s conditions and monthly payment that work best for you and enter a few more details to finish your application.

- And last, after approval, the money can already be in your bank account the following working day.

Pros

- Borrowers with low credit scores and low annual incomes can apply for loans.

- No prepayment penalty charges

- Fast and flexible application and funding process.

Cons

- Additional 0 to 6% origination fee.

- High annual percentage rates.

- Co-signers are not allowed.

- Not provide financing services in NV and WV.

- The loan amount goes directly into the borrower’s account and not to any third-party creditors.

Customer Reviews: According to consumersadvocate.org Ratings,

What are other solar panel financing options?

Solar loans and home equity loans are the primary and most suitable solar financing options available for homeowners when it comes to taking residential solar loans. However, there are several other multitudes of options out there, which are as follows:

Home Equity Loan and HELOC

Home Equity Loan: You can utilize a home equity loan to obtain money against the value of your house and then use the money to pay for solar panels. A home equity loan will normally have a cheaper rate of interest than a loan for solar panels because the house is the security, but you run the danger of losing your home if you don’t pay it back. Homeowners can typically borrow no more than 85% of their house’s equity from home equity providers.

HELOC: Home Equity Line of Credit (HELOC) is similar to home equity loans, but it is different in a way that instead of getting a pile of cash, you will get a line of credit against your home, and it is more like a credit card, which you can further use more or less as per your daily needs. These types of loan facilities are offered by primary bank providers and usually have varying rate loans that put you at a greater rate of interest volatility than personal and home equity loans.

Cash-out Refinance

A second loan that is larger than your present loan is known as a cash-out refinance. You repay the previous loan with the new one, then “cash out” the extra money to pay for solar panels. If you can reduce closing expenses to a minimum and current lending rates are less than what you are paying, it is a viable alternative.

Closing charges range from 3% to 6% of the amount of the mortgage. Therefore, closing expenses for a $300,000 mortgage might be $18,000, which is substantially more pricey than certain solar panel installations.

Solar lease and PPA:

Solar leases and power purchase agreements (PPAs) are another common solar financing option provided by solar installers, which lessen homeowners’ vulnerability to financial risks from solar panel system failure, unexpected upkeep and operation costs, and delays in getting rewards and grid interconnection approval. That is zero upfront and maintenance costs. However, there is a significant difference between the two of them.

Solar Lease: In a solar lease, a solar power system on the homeowner’s property is installed and owned by a solar leasing firm, which receives set payments from the homeowner in exchange for signing a service contract. Customers are frequently entitled to compensation under contract provisions if the system generates much less electricity than anticipated.

PPA: Homeowners who sign a solar PPA are responsible for paying for the electricity produced by the installation. A solar TPO (third-party ownership) owns, sets up, and manages a rooftop solar system on a homeowner’s property. Through a long-term contract, the client then purchases the energy produced by the equipment on a per-kWh basis. As a result, the consumer can utilize solar energy for a set price without having to pay the system’s upfront cost or handle its management and maintenance.

Overall, solar loans are generally a great alternative for newer residences with high incomes but minimal equity built up. Additionally, there are utilities, states, and municipalities, as well as nonprofit organizations that support solar energy by providing low-cost or interest-free financing. In our larger essay on solar financing, we examine such possibilities.

Conclusion: How do I find the right solar financing company?

Finding the right solar financing company is directly connected to finding the right solar panel installer. Many times, homeowners have their eyes only on solar panels, but panels do not comprise the whole system and process. There is a complete list of solar equipment and loaning things involved in it.

So, look for a solar service provider who can arrange all these things for you in one place. These days, many giant solar companies like Sunpower have direct contacts with solar financing companies that can help you install an entire PV system on your property with their affordable financing plans, including loaning, leasing, and power purchasing.

However, it is wise to go through the multiple solar financing companies and see what they have in store for you. Compare their quotes, and then make an informed decision.

We hope the aforementioned list helps you find the best one for your home, and in no time you will be taking advantage of renewable energy and saving more on power bills.

If you have any other doubts regarding solar financing, then feel free to drop them in the comment section below. We will be glad to help you.